omaha ne sales tax calculator

How much is sales tax in omaha. Call us for a free consultation.

Request a Business Tax Payment Plan.

. The Omaha Nebraska sales tax rate of 7 applies to the following 39 zip codes. Omaha in Nebraska has a tax rate of 7 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Omaha totaling 15. OutSource One Bookkeeping Services LLC - Fair pricing.

The Nebraska state sales and use tax rate is 55 055. The calculator will show you the total sales tax amount as well as the county city. Name A - Z Sponsored Links.

Sales Tax State Local Sales Tax on Food. How much is sales tax in omaha. Nebraska sales tax details.

Sales Tax Calculator in Omaha NE. Sales and Use Tax. The Nebraska sales tax rate is currently.

Name A - Z Sponsored Links. Driver and Vehicle Records. The nebraska state sales and use tax rate is 55 055.

Over 25 years of experience. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. Sales Tax Rate Finder.

The Nebraska state sales and use tax rate is 55 055. Well help you identify key tax planning opportunities to minimize your future tax liabilities and calculate how much sales tax you owe. The December 2020 total local sales tax rate was also 7000.

Taxes-Consultants Representatives Tax. Sales Tax Calculator in Omaha NE. Sales tax in Omaha Nebraska is currently 7.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Omaha NE. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Omaha NE.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated. The minimum combined 2022 sales tax rate for Omaha Nebraska is. The nebraska state sales and use tax rate is 55 055.

The sales tax rate for Omaha was updated for the 2020 tax year this is the current sales tax rate. Method to calculate Omaha sales tax in 2022. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Omaha NE.

Sales tax in omaha nebraska is currently 7. Registration Fees and Taxes. If youre an online business you can connect TaxJar directly to your shopping cart and.

Taxes-Consultants Representatives Tax Return. Sales tax in omaha nebraska is currently 7. This is the total of state county and city sales tax rates.

You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. The current total local sales tax rate in Omaha NE is 7000. Real property tax on median home.

Make a Payment Only. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The Nebraska NE state sales tax rate is currently 55.

The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. How much is sales tax in Omaha in Nebraska. You can find more tax rates and.

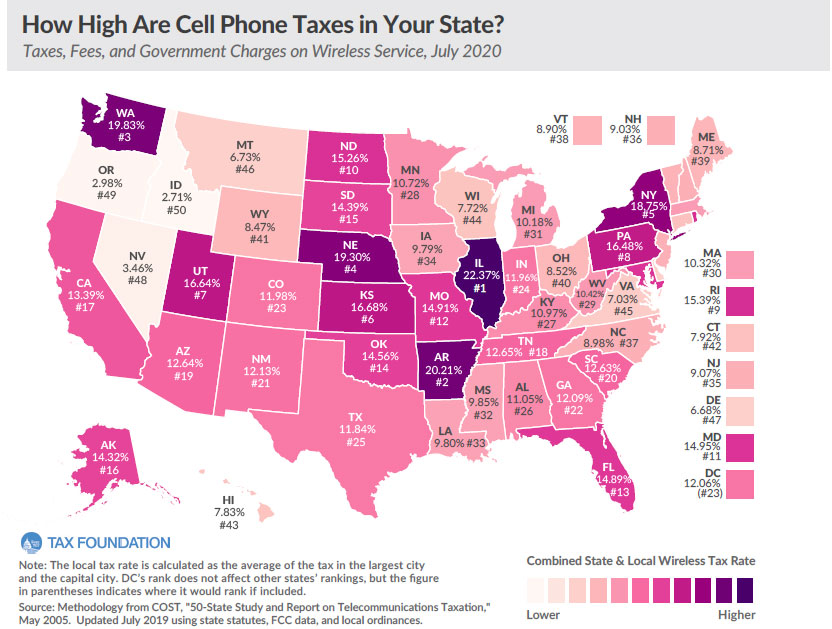

Nebraska Has 4th Highest Wireless Tax Burden In The Nation

6019 N 152 Ave Omaha Ne 68116 Mls 22225610 Redfin

Expert Advice For Moving To Omaha Ne 2022 Relocation Guide

M U D S Role As Billing Agent For Sewer Fees Metropolitan Utilities District

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Omaha Real Estate Market Prices Trends Forecasts 2022

Nebraska 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Use This S Corporation Tax Calculator To Estimate Taxes

Nebraska Sales And Use Tax Nebraska Department Of Revenue

The Ultimate Guide To Ecommerce Sales Tax In 2022

Monthly Car Payment Calculator Woodhouse

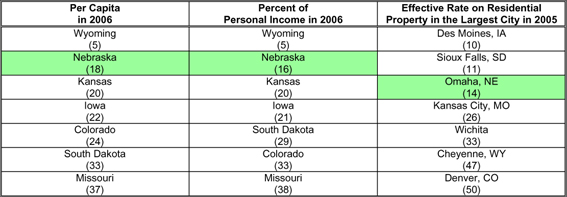

Taxes And Spending In Nebraska

Taxes And Spending In Nebraska

U S Cities With The Highest Property Taxes

![]()

Free Nebraska Payroll Calculator 2022 Ne Tax Rates Onpay